Brief History of Coins and Currency

India is one of the few claimant nations for earliest introduction and usage of coins, made from stone and metals as store and media for exchange of values. These most probably had ringed bells for stoppage of barter system. Researchers have observed that use of coins in India dates to period from the first millennium before the common era (BCE) to the 6th century BCE. Before such metal coins ‘Cowrie Shells’ and beads used to be exchanged as money for buying of goods and services.

Historians could trace coin minting activities in India during the period of several ancient rulers of kingdoms, viz., Magadha, Ghandhara, Shakya, Surasena, Panchala, etc. They launched such coins for use as legal tenders by their subjects. Those coins were known as Pana or Karshapanas. Historians could also find that Chinese and Lydian rulers of middle east region were two of the earliest introducers of coins. Mughal emperor Sher Shah Suri minted the first gold coin, called Mohur in India, during his rule between 1540 to 1545. Storylines indicate that the modern version of the name of Indian currency ‘Rupee’ owes its historical lineage from the silver coin called ‘Rupiya minted by Sher Shah Suri. It is pertinent to note that Indian word for silver is ‘Rupa’

Fiat Currency and Bank Money

This tradition of metallic coins continued till the advent of British era in India around which time paper currency notes started replacing metal coins with high intrinsic values. However, centuries old tradition of using metal coins continues even today albeit on a reducing trend. The colonial rulers of India started blocking village level Indigenous bankers, who used to operate with metal coins, at the onset of their rule. Organised banks, sponsored by both private owners and government, started operating on a regional basis.

The General Bank of Bengal and Bihar, a state sponsored bank, was one of the first few issuers of paper currencies during 1773 to 1775. Since then both private and government sponsored banks used to issue paper currencies which were used by people in regional markets. According to a publication of Reserve Bank of India1, “The paper currency Act of 1861 divested these banks of the right to note issue; the Presidency Banks were, however, given the free use of Government balances and were initially given the right to manage the note issues of Government of India.” This Act heralded the control of the Indian central bank on fiat currency and money circulation in India.

Presently there are three types of money in the financial ecosystem of any sovereign country, viz.,

- Fiat Cash or Currency: It is issued and controlled by its central bank and not backed by any commodity like gold. Fiat currency provides greater control to the central bank on the country’s economy.

- Central Bank Money: This money is created out of reserves of a country’s central bank and is used by commercial banks for settlement of transactions by and between themselves. Total magnitude of this form of money is not considered as a part of money supply to the economy as it is not meant for any purpose beyond the close circuit of country’s banking ecosystem.

- Central Bank Money: This money is created by government and private commercial banks by lending to retail, and corporate customers from out of various short-term and long-term deposits received from retail and institutional customers. This huge bulk of money is stored in the computerised accounting systems of banks and circulates through innumerable day-to-day transactions conducted by banks’ customers.

It is, therefore, evident that all the above three forms of money are, for all practical purposes, under direct monitoring and control of the central bank of any country, because the commercial banks are also under regulatory control and close supervisions of the central bank.

Birth of the Cryptographed Digital Currency

Digital currency originated from the disgruntled mindset and anguish of common people that banks have failed to provide security and safety of their deposits, not to speak of reasonable return in real terms net of inflationary effect. A section of people wanted to become the controller of their own destiny due to heightened anguish caused by global financial crisis post subprime loan meltdown in September 2008. In India, the matter has assumed critical dimensions due to recent failures of a couple of banks to meet commitments to retail customers primarily caused by persistent huge quantum of non-performing assets, i. e., long overdue loans and interests thereon.

Readers may be aware that the first idea of digital currency can be traced in 1998 when an IT engineer called Wei Dai2 published a paper on digital currency called ’B-Money’. His idea was to enable a group of unnoticeable ‘Digital Pseudonyms’ to transfer values within a network. In the same year Nick Szabo2, ideated another decentralised digital currency called Bit Gold. This lawyer turned professional cryptographer was one of the pioneers of blockchain technology. Szabo claimed that his idea was provoked by inadequacies in the traditional banking systems. However, both these were never launched in public domain.

The world witnessed birth of the first cryptocurrency ‘Bitcoin’ in 2009 through the widely read article “Bitcoin: A Peer-to-Peer Electronic Cash System”, published by Satoshi Nakamoto3. Predominant objectives of Bitcoin were to liberate liquid assets of common people from the clutch of central bank of a country, so that people can control their own destiny. World debated whether Wei Dai, Nick Szabo and Satoshi Naka are one and the same person with three different names. The most debated issue that remains to be concluded is, whether privately issued cryptocurrencies have really so far served the originally ideated objectives.

The author is not aware whether the mystery around the name Satoshi Nakamoto has yet been demystified, and whether the person has physically been traced anywhere under the sun. However, one school of thought is that the name represents a group of IT professionals who ideated virtual currency. The quoted article of Satoshi Nakamoto claimed the following:

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work…..”

Satoshi Nakamoto created a digital platform for steering transactions by participants in a peer-to-peer network for Bitcoin using Blockchain Technology which is synonymously known as ‘Distributed Ledger Technology’ (DLT).’ The underlying basis and controlling tool is an embedded smart contract entered by and between transacting parties, as opposed to any central bank’s regulations. The author in some of his previous articles in this series on ‘Digital Transformation’ has explained Blockchain technology in detail, and hence are not being repeated here. Those articles are available at his personal

website: http://www.innoventionians.com/category/knowledge-inputs/

Cryptocurrency Transactions without Intermediation

The decentralised and distributed authority structure between participants of a Blockchain platform enabled a digital currency to remain beyond the realms of regulations and control of any central authority. The peer-to-peer network facilitates direct online remittance payments by and between participants without the intermediation of any common agency like a bank.

The word crypto draws allegiance from the fact that every transaction in a blockchain platform is cryptographed on an end-to-end basis with complex algorithms. Such applications of cryptography are also for ensuring controlled addition of new digital currency units; authenticate, monitor, and record transactions; and to create a risk-enabled safety net to prevent frauds and infringement by cyber criminals. Applications of algorithms for encryption render such a digital currency near impossible to be counterfeit or double-spend. That is why any digital currency transacted through a blockchain platform is also called ‘Cryptocurrency’.

A cryptocurrency is synonymously known, and also being used in this article, as Digital Cash, Digital Asset, Digital Currency, Digital Token, Virtual Currency, etc. It is touted to function as an alternate medium of exchange to secure financial transactions and verify transfers through a secured and integrated DLT platform. Investopedia4 summarises that “Cryptocurrencies face criticism for a number of reasons, including their use for illegal activities, exchange rate volatility, and vulnerabilities of the infrastructure underlying them. However, they also have been praised for their portability, divisibility, inflation resistance, and transparency.” Since 2009 the world has seen launch of many cryptocurrencies. The following is a pictorial illustration of some of those:

Source: https://www.rarealtcoin.com/worlds-top-3-scrypt-algorithm-altcoins-long-term/

Despite all hypes around bitcoin and its price breaking through the summit of USD 20,000, cryptocurrency is yet to be a familiar word to a common man and meant for her / his daily use like internet or a application like WhatsApp. Most of high-net-worth individuals around world have yet not accepted cryptocurrencies, including Bitcoin a safe haven to invest.

Albeit all these, threat to fiat currencies and bank money under any central bank’s control is continuing. Readers are aware that mighty facebook is expected to launch a cryptocurrency called Libra. Many resistances forced it to initially launch Libra at a lower scale around April 2021. Because of gargantuan mass appeal of facebook even to the lowest strata of society across all countries and its worldwide network, Libra is expected to be popular within no time. It is likely to pose tangible threats to fiat currencies and commercial banks’ money regulated by any country’s central bank.

Industry 4.0 and Fintech for Digital Payment

Digital transformation of industrial operations and service deliveries by entities in banking, insurance, and other financial services (BFSI) started from around the later part of 1990s. But even before that came physical media for cashless payments through Debit Cards and Credit Cards issued by commercial banks. According to a report in Marketplace5 Kansas City Federal Reserve, a bank in the USA, started the first Debit Card in 1966. It reported that “Robert Manning, the author of Credit Card Nation, said debit card usage picked up in the ’80s and ’90s as more and more ATMs started cropping up across the country. In 1990, debit cards were used in about 300 million transactions. In 2009, prepaid and debit cards were used in 37.6 billion transactions.”

With further advancement of technologies digitally enabled cash-less payment started gaining momentum and reached today’s version of digital wallets and payment interfaces. Specific computing applications enabled individuals to make payments without use of Debit and Credit Cards, or any other form of intermediation by banking system. Usage of such debit and credit cards also came up with advanced applications like PIN less / touch less payment confirmations. Even before onset of Covid-19 Pandemic many startups developed digital solutions for contactless payment systems with applications of technologies like radio frequency identification (RFID) and near field communication (NFC). World witnessed emergence of eWallets and digital payment platforms of PayPal, paytm, ApplePay GooglePay, SamsungPay and so on. The case in point for an eWallet is the one used by car hailing service providers like Ola.

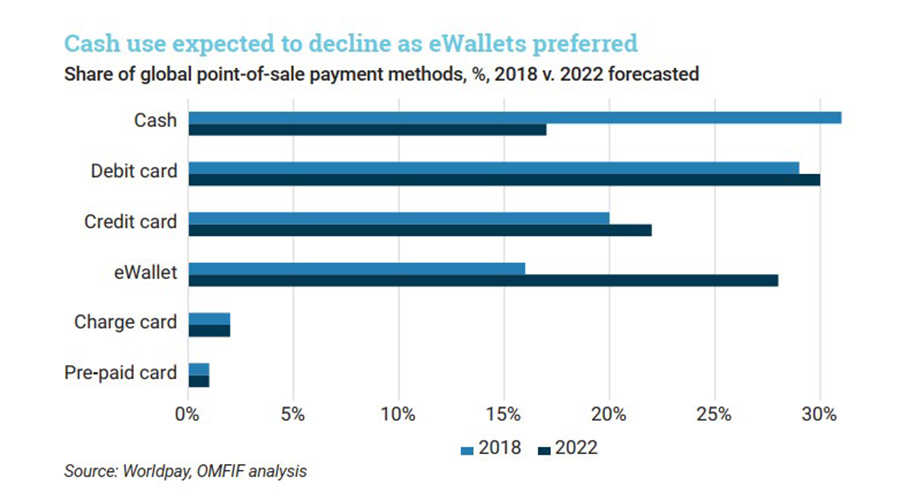

The following chart of a research-based report by Worldpay, published in a report of IBM6 use of hard physical feat currency will decline from about 32% in 2018 to about 17% in 2022. Use of eWallets will increase from around 16% in 2018 to about 29% by 2022.

Source: https://www.mfif.org/wp-content/uploads/2019/11/Retail-CBDCs-The-next-payments-frontier.pdf

Multiple Opinions on Cryptocurrencies

Readers should not be surprised to note that regulators around the world are divided in their opinions about the exact nature of a cryptocurrency as an asset and store of value. Many have even regarded it as a commodity and advised their respective sovereign government to impose value-added tax on related transactions.

Four major regulators of the world’s largest economy had initially expressed three different views on digital currency, Bitcoin to be precise. The author through his research observed that in a panel discussion session of a Blockchain Summit at the New York City Bar Association in June 2018 those four Regulators deliberated on various related issues. They represented the Securities Exchange Commission (SEC), the Commodities Future Trading Commission (CFTC), the Financial Crime and Enforcement Centre and the Internal Revenue Services (IRS). The Moderator of the session pointed out how different regulators do not even use the same language to define digital tokens or cryptocurrency: Those regulators considered digital tokens as:

- SEC – Securities

- CFTC – Properties

- FinCen – Currency

- IRS – Properties

The said Moderator was not sure whether concerns about regulations are likely to dissipate anytime soon. His question was if the layers of regulation could lead to new financial technology being developed in other countries instead of the USA. However, clarity of thought amongst regulators and multilateral agencies is an essential necessity for the fourth type of asset to come up in this era of Industry 4.0 for successful and all-pervasive digital transformation.

The author would prefer to add the following to clear misgivings in minds of common people, who are of the view that failure of Blockchain technology is responsible for several reported frauds related to crypto currency transactions. Many have concluded that Blockchain, like any other technology, cannot prevent frauds. Let this be clearly understood that the meteoric rise and volatilities in prices of Bitcoin and other cryptocurrencies are not due to the fault of Blockchain as a technology. Instead, those are mainly due to interplay of factors, viz., demand, supply, dogma of a new capital asset, human gluttony and other common factors influencing business and financial ecosystem of any country. The author is of the view that:

- Those are not the frauds committed by infiltrating into the concerned Blockchain platform. Human gluttony and ulterior motives have played forceful roles like in any other case of economic offenses.

- The reported frauds had occurred in course of cryptocurrencies being traded in exchanges operated by separate entities. Most of the buyers and sellers do not directly access the Blockchain platform from their respective Nodes. Their brokers in those exchanges do, unscrupulous activities by whom can never be ruled out and ignored.

Having observed differences in opinions of the US Regulators, research scholars Stephen J. et al, in their article7 published by Harvard Business Review in July 2018, had suggested the following in the context of the USA for resolving issues surrounding cryptocurrencies:

- Encourage formation of a self-regulatory body to promote and enforce standards among the crypto community.

- Convene an inter-agency working group, including representatives from the crypto community, to harmonize existing regulatory practices and develop a formal policy on cryptocurrencies.

- Provide public notice of a proposed rule governing cryptocurrencies and gather comments.

- Officially recognize that the extent of decentralization is an important factor in determining whether a cryptocurrency is a security.

- Go beyond the appointment of a crypto czar. Let SEC follow the lead of the Commodities Future Trading Commission, USA which created LabCFTC, an initiative for promoting innovation in fintech. Cues from that would give SEC opportunities to directly engage with industry to address questions about enforcemen of securities related laws to blockchain technologies before launch.

They were of the view that these steps will help to promote order, consistency, and accountability within the cryptocurrency market without imposing undue burdens. Such steps would help the United States emerge as a wise leader for regulating introduction and use of cryptocurrency. This will in turn spur entrepreneurship and innovation in this country. According to them “Wisdom – more than ignorance – is a truer form of bliss”.

Readers might have by now guessed that importance of bank as an intermediator, particularly for country’s payment and financial settlement ecosystem, is reducing day by day. Besides payments, applications of blockchain platforms have started being used for end-to-end handling of both domestic and cross border trade finance transactions, management of bonds, peer to peer lending loan management by microfinance organisations and many more. However, digital transformation involving interoperability of Blockchain platforms for transactional applications are being impeded due to non-availability of a commonly accepted digital currency. Industry sectors like financial services, healthcare, eCommerce, supply chain management, aggrotech, etc., and even governmental services too are the most affected segments.

Emergence of CBDC

IBM in its publication titled ‘Retail ÇBDCs – The next payment frontier’6 of 2019 has aptly reflected the concerns of both common people and central banks. It stated that, “Advances in financial technology are impelling central banks to react to emergent challenges from the private sector and address weaknesses in payments systems. Policy makers are concerned about the potential loss of monetary control, and there is momentum in their institutions to examine the potential effects of introducing retail CBDCs”. Since the global financial crisis of 2008 all stakeholders of monetary and banking systems around the world have squarely been influenced by the following three major developments:

- A dramatic multiplication of a sense of trust deficiency in behaviour and functioning of regulators, banks, and financial institutions.

- Efficacies of policies and systems of central banks related to oversight of banks and financial institutions befitting the fast-changing and country / region specific dynamic environment of industry trade and commerce.

- Continuous fall in usage of cash due to innovative digital solutions offered by startups for payments and remittance management with improved speed, quality, reliability, and cost effectiveness.

In such a given dynamic financial environment and crisis of trust cryptocurrencies are slowly and steadily becoming global. Such an escalated trend of cryptocurrencies is leading to more and more acceptance and use cases. Major corporate houses around the world are showing higher degree of interest in blockchain and cryptocurrencies by investing more for those. All these will speed up the process of expanding markets for digital currencies. Time is here and now for central banks of sovereign nations to also roll out their respective cryptocurrencies called Central Bank Digital Currency (CBDC).

It would be worthwhile to understand now the definition of CBDC. The Committee on Payments and Market Infrastructure (CPMI)8, appointed by the Bank of International Settlement (BIS), explained nuances of CBDC in the following lines.

“CBDC is potentially a new form of digital central bank money that can be distinguished from reserves or settlement balances held by commercial banks at central banks. There are various design choices for a CBDC, including: access (widely vs restricted); degree of anonymity (ranging from complete to none); operational availability (ranging from current opening hours to 24 hours a day and seven days a week); and interest-bearing characteristics (yes or no). … Many forms of CBDC are possible, with different implications for payment systems, monetary policy transmission as well as the structure and stability of the financial system. Two main CBDC variants are ……. a wholesale and a general purpose one. The wholesale variant would limit access to a predefined group of users, while the general purpose one would be widely accessible”

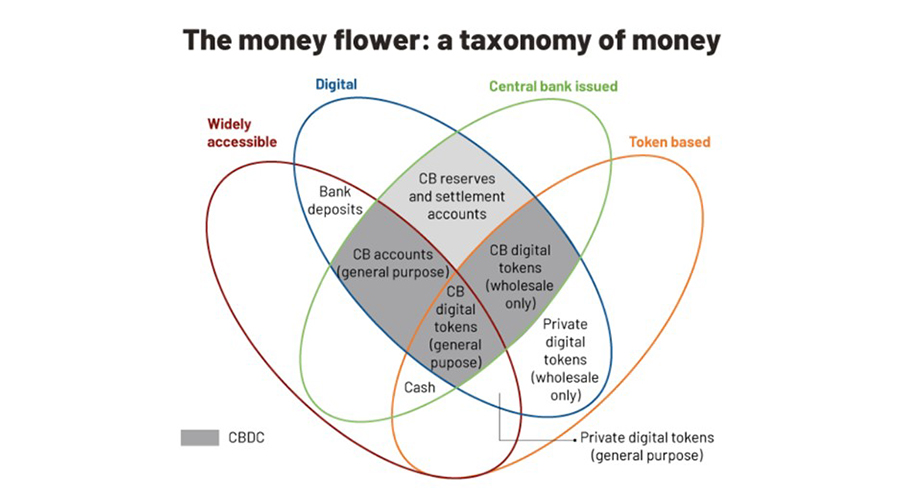

The following graphics aptly summarises the features of CBDC by combining more than one Venn Diagrams and naming their cross sections. This combined iconic expression is called ‘The Money Flower’ developed by way of Taxonomy for CBDC in 2017 by Morten Bech and Rodney Garratt for BIS.

Not much of narratives are required to explain the above diagram as most of the features of a digital currency and CBDC have been explained in the aforesaid discourse. Attention of readers is drawn to the shaded portions which depicts the distinguishing features of four possible types of Customers’ Accounts for usage of CBDC, viz., Reserves and Settlement, General Purpose usage of CBDC by Retail Customers, Digital Tokens for General Retail Customers and Digital Tokens for Wholesale Customers. This diagram has also featured Cash (fiat currency notes / bills) and General Purpose Digital Tokens issued by private entities.

Initiatives of Major Central Banks for CBDC

A report9 published in 2020 by seven of the world’s largest central banks jointly with the Bank of International Settlement defined CBDC as “…. a digital payment instrument, denominated in the national unit of account, that is a direct liability of the central bank.” The report highlighted the following:

- Coexistence with cash and other types of money in a flexible and innovative payment system.

- Any introduction should support wider policy objectives and do no harm to monetary and financial stability.

- Features of a CBDC should promote innovation and efficiency.

The group had promised to continue to work together on CBDCs, “without prejudging any decision on whether or not to introduce CBDCs in their jurisdictions.” More reading of the above report reveals the following features of a CBDC:

- A digital asset issued by a central bank.

- Objective is to facilitate payment and settlement.

- Usable for retail transactions by all common man as a digital extension of cash at no additional cost

- Usable for settlement of wholesale transactions to be conducted and settled by permissioned corporate entities in an interbank market.

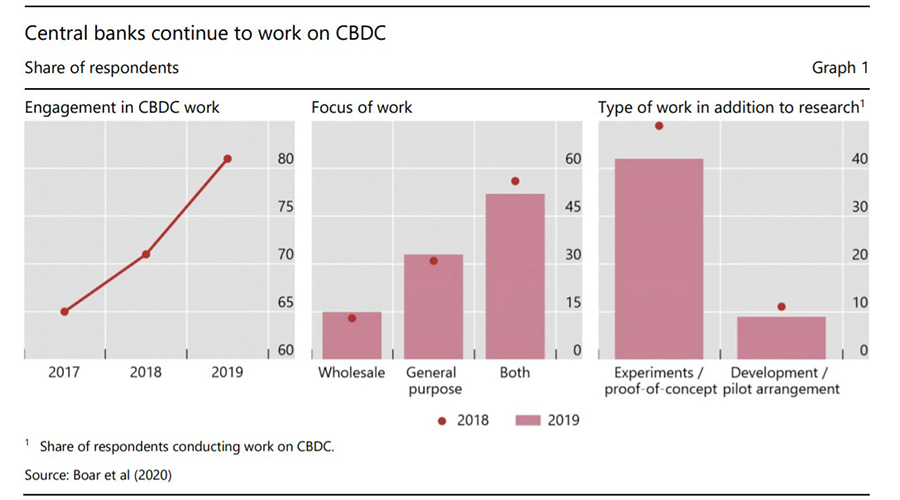

The report assured people in general by stating that “Arguments for and against issuing a CBDC and the design choices being considered are driven by domestic circumstances. There will be no “one size fits all” CBDC. Yet domestic CBDCs would still have international implications. Cooperation and coordination are essential to prevent negative international spill overs and simultaneously ensure that much needed improvements to cross-border payments are not overlooked.”. The following chart, included in the said joint report, brings out the present state of affairs in matters of initiatives by central banks of various countries for introducing CBDC.

Source: https://www.bis.org/publ/othp33.pdf

One can make out that more than eighty central banks of different countries have engaged themselves in preparatory work for introducing CBDC. About fifty of them have focussed on both Wholesale and General Purpose CBDC. And about fifty of those central banks are in varying stages of experimentation with proof of concept and pilot arrangements. Wim Boonstra. Senior Vice President, Special Economic Advisor and Economist at RaboResearch Global Economics & Markets, in his article of December 202010 has indicated that, “People’s Bank of China (PBoC) has developed the Digital Currency for Electronic Payment (DCEP)”. The summary of his report runs as under. All these have, however, not further been researched and confirmed by the author of the present article:

- China may be the first major country to launch a central bank digital currency or CBDC

- The Chinese CBDC, named DCEP, will strengthen the position of the central bank and help to further modernize the Chinese economy

- The DCEP will probably also be available for China’s trade partners, to begin with Africa

- The DCEP may strengthen the international position of the renminbi to the detriment of the euro

- The arrival of the DCEP should be a strong wake-up call for Western, especially European, policymakers.

The important point to be noted here is that DCEP, the CBDC of China may be a digital currency that will be accepted as a medium of financial transactions in certain African countries who are China’s trade Partners.

Tanjeel Akhtar in her article11 of December 2020 wrote about a digital currency which has been issued on a limited scale within a city area. The Spanish City Council of Lebrija has created the virtual currency Elio to support economic activity during the COVID-19 pandemic. One Elio is equivalent to one euro and almost 600 families will receive between €20 (US$24.50) and €200 ($244.96), which can only be spent in local businesses using an app. The deadline to use the Elio was Dec. 31, 2020, but has been extended till March 31, 2021.

IMF’s Working Paper and Anxieties on CBDC

IMF published its Working Paper12 titled, ‘Legal Aspects of Central Bank Digital Currency: Central Bank and Monetary Law Considerations’ as late as on November 20, 2020. It would be useful to quote verbatim the summary for better understanding of readers:

“This paper analyzes the legal foundations of central bank digital currency (CBDC) under central bank and monetary law. Absent strong legal foundations, the issuance of CBDC poses legal, financial, and reputational risks for central banks. While the appropriate design of the legal framework will up to a degree depend on the design features of the CBDC, some general conclusions can be made. First, most central bank laws do not currently authorize the issuance of CBDC to the general public. Second, from a monetary law perspective, it is not evident that “currency” status can be attributed to CBDC. While the central bank law issue can be solved through rather straight forward law reform, the monetary law issue poses fundamental legal policy challenges.” Readers will get a feeling that the Authors of the Working paper are admittedly:

- Not clear about certain legal aspects and implications of CBDC on the functioning of commercial banks and central bank of respective countries.

- Not sure whether central banks of a country need to be legally authorised for issuing CBDC to public in general.

- Apprehensive about the fact that absence of legal foundations CBDC may cause legal, financial, and reputational risks for central banks.

In addition to the above concerns of IMF the author’s more research work reveals that economists and finance professionals have expressed anxieties on the following issues which extend far beyond the issues related to payment systems, legislative amendments, and collaboration with private technology providers for running the blockchain based platforms:

- CBDC permitted by a Central Bank for issuing to common people may result in higher volatility and insecurity in deposit funding of commercial banks.

- A general purpose CBDC can be a self-competitive item vis-à-vis the existing term of deposits related services provided by commercial banks with pre-declared assured rates of interests. This may also pose challenges for funding and financing structure of banks.

- In an assumed condition that CBDC is only legalised for payment and settlement purposes, commercial banks and central banks of a country may have to encounter grievous challenges, and then successfully handle the same in periods of stress when a flight towards the central bank may occur on a fast and large scale.

- Institutionalisation of CBDC with legislative permission will result in wide-spread and more than existing presence of central banks in a financial ecosystem of a country, which may not be desirable.

- Introduction of CBDC would bring in its wake a much wider role for central banks in distributing financial resources. It may cause directional changes in roles and responsibilities of central banks into uncharted territories which may result in high degree of political interferences and eventual financial losses for central banks.

- Setting principles, policies, and standards to be complied with for the technology to be applied and digital platform to be maintained for operations with CBDC would be a challenging additional burden for central banks besides ensuring privacy, safety, and security of information.

Carlos et al in their seminal work13 titled ‘The Future of Money and the Central Bank Digital Currency Dilemma’ identified the following risks in the context of cryptocurrency and CBDC:

- Risks of a cashless society,

- Risks of structural bank disintermediation,

- Risks of systemic bank runs,

- Risks of currency substitution, and

- Risks of economic and financial bubbles.

Readers may refer their paper describing ‘Three-Pillar Monetary-Financial Framework’. They have claimed that their proposed framework will guide the assessment of CBDCs which are considered as the next step in monetary evolution.

Global Status of CBDC

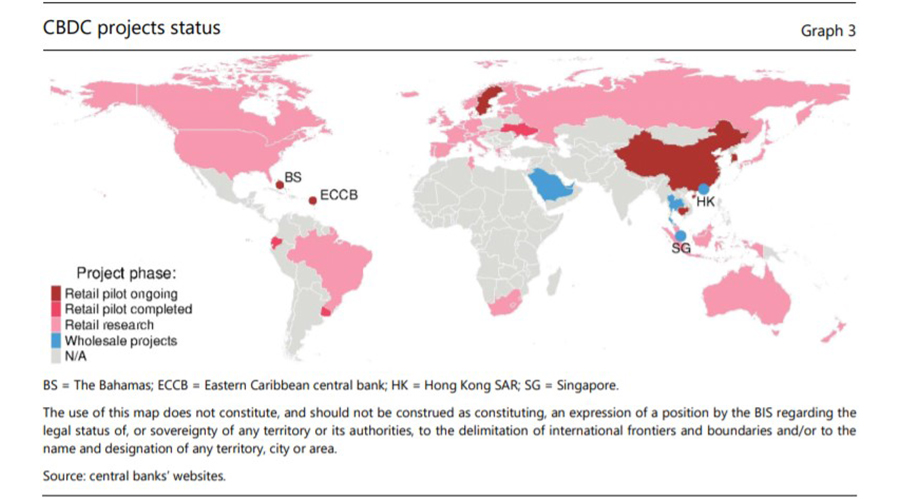

Working Paper No. 88014 of Bank of International Settlement, published in August 2020 has presented the status of implementation of CBDC around world till July 2020 through the following graphical expression of world map:

Source: https://www.bis.org/publ/work880.pdf

It is evident that most of the developed countries of North America and Europe, Australia, New Zealand, South Africa, north-eastern countries of South America have completed pilot study for Retail CBDC. In China the same is under progress. Projects for Wholesale CBDC is under progress in Gulf countries, Hong Kong and a few countries of East Asia.

BIS has further explained in the said report that, “As of mid-July 2020, at least 36 central banks have published retail or wholesale CBDC work (Graph 3). At least three countries (Ecuador, Ukraine and Uruguay) have completed a retail CBDC pilot. Six retail CBDC pilots are ongoing: in the Bahamas, Cambodia (Bomakara (2019)), China, the Eastern Caribbean Currency Union.”

Readers may be amazed to note the progress in countries which are smaller than India. With this pace of progress, it may not be wrong to visualise that by around 2025-27 the world will see worldwide initiation of CBDC even for settlement of cross border transactions, which will eventually render decades old usage of SWIFT redundant.

Present Status of CBDC in India

The National Institute of Smart Governance of India published the ‘National Strategy for Blockchain’15 in December 2019. In this document the concept of ‘Central Bank Digital INR’ (CBDR) was mentioned. The stated objective is to facilitate the process of innovation in areas of digital transformation. It suggested that CBDR can be operated through a ‘National Permissioned Blockchain’ platform that can run decentralised operations. The document suggested that, “Permissioned blockchain applications can also account for regulatory oversight through participatory nodes by corresponding regulators and leverage the National Public Blockchain platform as a trust anchor.”

The Indian newspaper Mint16 reported on December 5, 2019 that RBI Governor Saktikanta Das has ruled out the possibility of granting permissions for privately-issued digital currency. He has been quoted to have said that it was a little early to talk of Indian Central Bank issuing CBDC, albeit RBI had internally examined it and discussions being on. According to the Governor the related technology has not fully evolved.

Big Questions for Deliberations

A situation of chaos may arise if individual nations frame their own rules and regulations for introduction and management of CBDC from the narrow perspectives of meeting their respective country’s dynamics and serving their own interest only. This may hinder progress of cross border trading and settlement of transactional dues. The process involving 4Cs, viz., consultation, consensus, cooperation, and collaboration should be followed. Multilateral agencies like IMF, World Bank, OECD, etc should propagate directional guidelines, policies and procedures for digital solution designing, introduction, management, and monitoring of CBDC at individual national levels.

This should be done after consensus is reached based on views obtained on a working paper. Objective should be to derive maximum benefits out of innovative solutions being provided by digital scientists for safe, cost effective and speedier management of transactions for financing, trading, settlement of liabilities, remittances, etc, both at domestic and multinational levels. The ultimate goal should be to reach benefits to all human beings across all societal hierarchies of all nations.

One of the intrigued questions to be examined, and addressed by such multilateral agencies is, whether the central bank of any country should allow one or more cryptocurrencies issued by private entities like Bitcoin, Ethereum, Ripple, Libra, etc, to parallelly operate with CBDC. The issues that should also come for intense debate are the complexities and clash of interests which would arise due to such privately issued cryptocurrencies participating in transactions with decentralised authorities transcending sovereign boundaries. Some more complex issues to be resolved are:

- Whether the underlying economic foundation and the superstructure of financial ecosystem of a country will be shattered by such parallel applications of CBDC and privately issued cryptocurrencies?

- Whether at all there can there be peaceful co-existence of CBDC of individual nations and cryptocurrencies of private organisations?

- Whether any nation should allow their own CBDC to be used by another or more other nations which are financially helped and supported by them, as opposed to the present convention of every nation having their own currencies, and exchange rates being determined by market forces.

Conclusion

The author is of the view that CBDC is no longer a matter of option and choice for the government and central bank of any sovereign nation. It is an imperative and has become an essential necessity, CBDC with all its variants will soon emerge as the only option for keeping pace with digital transformation of industry, trade, and commerce, and particularly FinTech segment of BFSI sector.

Government of India and RBI should not and cannot opt to remain a quiescent spectator while common people increasingly embrace smart technologies for cashless / touchless payments, digital wallets and Banks in India face fierce competition from time efficient and cost effectively FinTech players. Discourse in this article has indicated the speed at which most of the developed countries are progressing with pilot runs of CBDC. It will prove to be expensive with retarding effects if actions are not initiated without any further delay. One should not continue to be under the impression that technology is still evolving. If need be technology has to be ‘innovented’. The author is aggressively optimistic about pervasive success of CBDC all around the world much before the end of the ensuing decade.

Webliography

- https://www.rbi.org.in/commonman/English/Currency/Scripts/EarlyIssues.aspx#:~:text=The%20paper%20currency%20Act%20of,issues%20of%20Government%20of%20India

- https://www.ledger.com/academy/crypto/a-brief-history-on-bitcoin-cryptocurrencies

- https://bitcoin.org/bitcoin.pdf

- https://www.investopedia.com/terms/c/cryptocurrency.asp

- https://www.marketplace.org/2011/08/18/short-history-debit-card/

- https://www.omfif.org/wp-content/uploads/2019/11/Retail-CBDCs-The-next-payments-frontier.p

- https://hbsp.harvard.edu/download?url=%2Fcatalog%2Fsample%2F10282-PDF-ENG%2Fcontent&metadata=eyJlcnJvck1lc3NhZ2UiOiJZb3UgbXVzdCBiZSByZWdpc3RlcmVkIGFzIGEgUHJlbWl1bSBFZHVjYXRvciBvbiB0aGlzIHdlYiBzaXRlIHRvIHNlZSBFZHVjYXRvciBDb3BpZXMgYW5kIEZyZWUgVHJpYWxzLiBOb3QgcmVnaXN0ZXJlZD8gQXBwbHkgbm93LiBBY2Nlc3MgZXhwaXJlZD8gUmVhdXRob3JpemUgbm93LiJ9

- https://www.bis.org/cpmi/publ/d174.pdf

- https://www.bis.org/publ/othp33.pdf

- https://www.zerohedge.com/markets/china-will-be-first-country-launch-digital-currency-what-happens-then

- https://www.coindesk.com/spanish-city-lebrija-launches-local-virtual-currency-elio

- https://www.imf.org/en/Publications/WP/Issues/2020/11/20/Legal-Aspects-of-Central-Bank-Digital-Currency-Central-Bank-and-Monetary-Law-Considerations-49827

- file:///C:/Users/DELL/Downloads/TheFutureofMoneyandtheCentralBankDigital-Sustainability.pdf

- https://www.bis.org/publ/work880.pdf

- https://www.nisg.org/blockchain

- https://www.livemint.com/industry/banking/no-way-privately-issued-digital-currencies-can-be-allowed-says-rbi-governor-11575535494050.html

This paper was first published in the January 2021 issue of ‘The Management Accountant’, the monthly Journal of the Institute of Cost Accountants of India.

About the Author

Dr. Paritosh Basu is presently a full-time Senior Professor of NMIMS University School of Business Management, Mumbai. He is a scholarly academician and a digital evangelist. He is also engaged in various research and consulting activities. Earlier he served large Indian corporates for about thirty-four years with last two assignments being of Global Group Controller and CFO in two large Indian MNCs.

He may be contacted at [email protected] or @paritoshbasu.

Main image credit: Photo by Viktor Forgacs on Unsplash

more insights

In the previous blog Why Dubai Wants To Rope In Blockchain?, we spoke on the blockchain technology with some latest information on why is Dubai so excited about it. We discussed about blockchain technology and its connection with the bitcoin technology and how it will give stress-free life to people as it requires a setup to be done only once.

Today, let us understand the three pillars of blockchain and how healthcare will be the most benefitted.

According to a press release statement by Smart Dubai, Dubai’s blockchain strategy will be built on three pillars:

- Government Efficiency,

- Industry Creation and

- International Leadership

Government Efficiency – The main reason to adopt this technology is to increase the government efficiency since blockchain will reduce the amount of documents used from 100 million in a year to zero. The other advantage of blockchain and the most amazing one is, these documents get updated on its own. There is no human intervention needed once everything is set. It is expected that blockchain will save up to 114 MTons of Co2 emissions once blockchain is implemented.

Industry Creation – There are multiple reasons why Dubai wants to pioneer in this technology. Apart from cementing Dubai as the first blockchain powered Government in the world, it also plans to include private sectors like real estate, healthcare, BFSI, transportation, energy planning and much more. This will help them create job opportunities not just for IT folks, but for non-IT employees working across sectors in Dubai.

International Leadership – This is a no-brainer. When every government in the world is fighting to solve either terrorism, unemployment or poverty; UAE has no such complications. Dubai is already a very exotic city to visit and blockchain will help visitors with faster checkouts on arrival, easy visa policies, centralised transport system for renting cars, unparalleled WiFi connectivity, amongst the rest.

As soon as Dubai is done with transferring all the documents to blockchain and getting them verified, officials will look to open this technology for the private sector as well. What is zestful here is Dubai Government is also planning to extend this technology to various cities and nations. Mohammed Abdullah Al Gergawi, Minister of Cabinet Affairs and the Future said in a statement: “Users will only need to log in their personal data or business credentials once; it will then be updated and verified in a timely manner through the blockchain network in all government and private entities including banks [and] insurance companies.”

Out of the countless advantages of implementing blockchain in Dubai, healthcare is one of the most looked upon sector.

From one of the best healthcare systems in the world to exceptional – Dubai is widely recognized and regarded for its healthcare as it has some of the best facilities in the world.

With the introduction of blockchain, Dubai plans to bring even more robust data integrity, security and the trust to allow sensitive patient information flow between health providers and the patient.

Carlos Domingo, Chief New Business & Innovation Officer at UAE Telecom du, said: “Today, majority of health records are on paper such as blood test reports, x-rays, etc. Most hospitals don’t have shared access of patients’ records which is inconvenient to the patient and time consuming at the end for the doctor or the care giver.

“By digitising all health records, and putting them in Blockchain technology, data can be shared and distributed across all hospitals. We are looking at fully digitising the health system with Blockchain technology to assure data integrity with zero error and guarantee end to end accountability of the patients’ records.”

Although it has many complications, implementing blockchain is an extremely ambitious but a promising move from the Dubai government. Blockchain is a new solution to establish trust between parties over the internet’s untrusted network. But there are people who ponder how it will give perfect, simultaneous, shared data between a number of different people, devices or businesses.

More specifically, blockchain is the technology that supports crypto currencies such as Bitcoin, but can it support the transfer of any data or digital asset? Such unresolved questions will be discussed at the first Blockchain Business Conference which is hosted by Fintech Valley Vizag with support from Ministry of Electronics & Information Technology, Govt. of India on 8-9 October 2017.

more insights

Since the arrival of Bitcoin in 2009, blockchain has been its backbone. There has been much written about blockchain that it is not ready and stable to rely upon. The reasons are also well thought out – the need for training people on blockchain, cost of investment in software, time to make all these a reality are amongst the usual excuses apart from ‘not wanting to change’.

There is also a view that until we understand how that model will look and work, it is difficult to develop any kind of blockchain promises that reflects industry practice. This is why blockchain is generally lagging behind.

But change is coming. At least in some parts of the world. Experts like Richard Kastelein, Founder Blockchain News, Cryptoassets Design Group & Blockchain Partners, Netherlands, believes, “In 2017, blockchain is still in the proof of concept phase. From my perspective, 2018 is when we will see initial adoption in some sectors. By 2020, wide-spread adoption will be the norm”

People often say they want blockchain without fully understanding what they actually want from blockchain. This is something which needs to be discussed with clients early on to ensure the contracts, protocols and the technology adoption reflect their organization’s objectives.

So where do blockchain technology go from here?

We asked the expert Richard Kastelein about this. He said, “The issues surrounding any implementation of blockchain is specifically related to the network effect – how many and who are using it. It becomes a domino adoption process once major players adopt it. Otherwise, it starts to exclude those players who have not adopted the technology. As more and more countries and companies move to the blockchain, the more it REQUIRES others to adopt the technology.

We are already in the information age, adoption of technology is pretty much accepted as inevitable.

We also asked Richard what smart advice would he give to start-ups working on blockchain, to that, he said, “Forget about coming up with the latest wallet or client. 99% of those firms will fail. Focus on providing useful skills and development capabilities to large sectors. There are few successful race car designers, however, there are many successful firms that supply the engines, the tires, the frames, the safety features that make up a beautiful race car.”

Read Richard’s full interview here

Richard Kastelein is one of the many speakers alongside Jack Shaw, Executive Director, American Blockchain Council; Jane Zhang, Founder and CEO, Shellpay, USA; Tim Lea, CEO & Founder, Veredictum.io, Australia and many more at Blockchain Business Conference.

This summit plans to host tech and blockchain giants to discuss ways how businesses should not only adapt blockchain technology in their budget; but also change their mind-set about it.

Fintech Valley Vizag is hosting this event in Novotel, Vizag on 9-10 October 2017.

For speaking, sponsorship or attending inquiries,

visit https://www.frankfrut.worldblockchainsummit.com/

more insights

Our earlier blogs detailed out Dubai’s interest in Blockchain technology, the three pillars of blockchain implementation, and an understanding of blockchain model – today we intend to dig deeper into the types of blockchain.

The reach of Blockchain will go far beyond than what it was intended for. While banking is only the beginning, Blockchain will slowly introduce itself in the sectors like cybersecurity, healthcare, automobile, education, sports management and what not!

Blockchain establishes trust, accountability, and transparency, while streamlining business processes. It is a peer-to-peer distributed ledger technology for a new age transaction application.

So what are Open Blockchain?

According to the tech giant IBM, “Open Blockchain is a ledger of digital events, called transactions, shared among different participants, each having a stake in the system. The ledger can only be updated by consensus of the participants, and, once recorded, information can never be altered. Each recorded event is cryptographically verifiable with proof of agreement from the participants.”

Examples range from Bitcoins to Litecoins.

And what are Closed Blockchain?

Exactly opposite as the name suggests, a Closed Blockchain is a private network that maintains a shared record of transactions. The network is accessible only to those who have permission and transactions can be edited by administrators. Some also refer Closed Blockchain as Database.

Examples: Hyperledger, Ripple, Eris

The whole point of distributed ledger having maximum integrity is lost.

One of the core design principles behind a blockchain is that it’s immutable. However since a Closed Blockchain is edited by an administrator, it will be difficult to keep a track on the central actors since they rely on trust. Because of all these, it is going to be extremely critical on who you give access to.

But not even an Open Blockchain is absolute.

Having Blockchain Open (like Bitcoins) means you trust no human but trust computer algorithms and machine learning. So basically you believe in no-one which makes everyone trustworthy. Just like the internet. Where we need only basic permissions (like Logging in) to communicate or use Google for search.

The most striking thing about having Blockchain as an Open source is programmers can build programs and applications using them. Just like IFTTT (IF This Then That). They are a free web-based service that people use to create chains of simple conditional statements, called applets.

Andreas M. Antonopoulos, one of the most respected Bitcoin expert terms it as ‘Innovation without Permission’. In one of the Bitcoin meet-up group Milwaukee, WI Feb 2014, Mr Andreas said, “When was the last time you saw someone build a bank out of their garage, and disrupt the financial services system to its core? Never. Why? Because they’re not given access, because access has to be trusted. On bitcoin anyone can create an application, and can innovate, and create new financial instruments. And that is pretty radical.”

This debate of having Open Blockchain or Closed Blockchain is taking rounds in various start-ups and educational institutions lately. Fintech Valley Vizag is hosting global Blockchain gurus under one roof on 9-10 October 2017 in Novotel, Vizag at the first Blockchain Business Conference. It features Blockchain experts who are nothing less than the foundation for new value creation in this emerging field.

For more information on the conference, get in touch with Vijay Walter, Head of Production on [email protected] or +9176196 13563

more insights

In January, Taipei signed a partnership agreement with the Germany-based IOTA Foundation to explore smart city solutions based on Tangle. IOTA is based on a distributed ledger technology called Tangle, that enables data and money to be transferred via its network. It offers secure data and money transactions between machines and has been already applied in millions of micropayments and use cases like secure Over-the-Air Updates, transparent value chains, and fee-free micropayment-based electric vehicle charging, etc.

IOTA is being tested in the automobile, manufacturing, and healthcare industries. Recently, Bosch (A German electronics giant and leading IoT patent holder) became one of the first multinational firms to invest heavily in IOTA. Volkswagen announced in January that their Chief Digital Officer, Johann Jungwirth, is joining the Foundation’s Supervisory Board, a hint that prospective collaborations with IOTA for the development of decentralized platforms and smart cars will take place in the near future.

BiiLabs (Blockchain Industry and Innovation Laboratories), a blockchain technology startup dedicated to the use of decentralized ledger technologies to drive business innovations, announced the official launch of their decentralized digital asset solution TangleID for corporate users. The TangleID system allows users to have “self-sovereign” verifiable digital identities based on blockchain technology, which is a software implementation scheme designed for Digital ID and GDPR regulations. This has already been adopted by ‘Taipei City Digital Citizen Cards’ project.

IOTA and Taipei City will develop multiple ways to adapt IOTA’s technology so as to contribute towards achieving the city’s goal of transforming itself into a smart city through a number of projects and authenticity concerns in public services and other spheres. Yichen Chu, aka Lman, co-founder and CEO of BiiLabs, said: “Based on IOTA, we have delivered the infrastructure to establish digital identity and credentials, and provide users with reference to mobile applications and website integration.”

The initial project will put in place a digital identification system based on IOTA’s TangleID technology. As Taipei’s Smart City Living Lab initiative enters its proof-of-concept phase, the city will soon roll out a new identification system—the Digital Citizen Card, which is designed to safeguard citizens from identity theft and voter fraud. The identification system could eventually be used in other public service domains such as document and record tracking in the healthcare industry. The prospect of “Digital Identity (Digital ID)” urges Taipei City to develop digital Citizen Cards in order to integrate online to offline (O2O) services for identity verification. The Digital ID opens up new possibilities for the access of industry services and provides flexibility regarding services or the payment on the service chain of identity authentication. The establishment of the platform for verification, service, payment as well as the well-established permissions for API will speed up drastically.

Taipei is already successfully conducting another experimental project with RealTek. They have deployed about 150 “Airboxes” around the city that collects and shares air quality data. The city is planning to integrate Tangle technology into these Airboxes with an incentive fee, paid in IOTA, for citizens with low carbon footprints.

Crypto congressman Jason Hsu aims to support the development of the cryptocurrency space and strongly believes that crypto organizations should adhere to certain standards. He had contributed his thoughts on regulating the Cryptocurency and Blockchain market at the World Blockchain Summit in Taipei. Witness groundbreaking views from leading entrepreneurs and industry leaders at the World Blockchain Summit in Dubai, as they educate the general public on the nascent technology.

more insights

It is never prudent to underestimate the ability of a hacker. One hacker or a small group of hackers can shut down an entire system, lure the unwary into cyber traps, steal millions worth in data and even topple down governments by leaking classified information online.

Blockchains alternative approach to storing and sharing information provides a way out of this security mess. The technology that can secure transactions with cryptocurrencies such as Bitcoin and Ethereum can also serve as a tool to prevent cyberattacks.

How will blockchain increase security?

1. Protecting identities: Public Key Infrastructure (PKI) is a form of public key cryptography that secures emails, messaging apps, websites and other forms of communication. But PKI relies on third-party Certificate Authorities (CA) to issue, revoke and store key pieces of information. Information that can be duplicated by hackers who can spoof identities that can get them through an encrypted system.

CertCoin is one of the first implementations of blockchain-based PKI, which removes central authority’s altogether and uses blockchain as a distributed ledger of domains and their associated public keys. CertCoin provides a public and auditable PKI that does not have a single point of failure.

This approach gives users a means to verify the authenticity of certificates with a decentralized and transparent source. It also has the side benefit of optimizing network access by performing key and signature verification on local copies of blockchain.

2. Protecting data integrity: Blockchain replaces secrets with transparency, distributing evidence across many blockchain nodes making it practically impossible to manipulate data without being caught.

Keyles Signature Structure (KSI) is a blockchain project that aims to replace key-based authentication. KSI stores hashes of original data and files on blockchain and verifies copies by running hashing algorithms and comparing the results with what is stored on the blockchain network. Any manipulated data will be quickly discovered because the original hash exists on millions of nodes.

3. Protecting critical infrastructure: The massive ransomware attack of May 2017 is a painful reminder of easy it has become for hackers to hold an entire infrastructure hostage. A blockchain approach to storing DNS entries could improve security by removing the single target that hackers can attack to compromise the entire system.

A transparent, distributed DNS where domain records are under their owner’s control will also make it virtually impossible for any single entity,

including governments, to manipulate entries at their whim.

4.Homomorphic Encryption: The essence of Homomorphic encryption is to enable for computations on encrypted data before its actual decryption. Currently, data privacy and transactions is upheld since computations may be done on the data but only those with the decryption key may access its contents.

Homomorphic encryption occurs in two main processes that are full and semi-complete arithmetic processes.

Fully Homopheric encryption schemes are said to be Turing-complete since they allow for both addition and subtraction operations on the ciphered messages. On the contrary, Semi homomorphic schemes like RSA only support operation on the ciphered text.

5. Zero Knowledge Proofs: An essential interaction for a blockchain can be through Zero Knowledge Proofs, cryptographic techniques that require two transacting parties, an authenticator and a verifier, to prove some propositions about the transactions without having to be true having to reveal all its information.

As the tech world evolves, so too the myriad of threats that come along with the march of evolution. Blockchain is not exactly a silver bullet that will fix everything wrong with the internet. Nevertheless it is a powerful tool that will help cyber security experts in stemming the oncoming onslaught of cyber attacks. It will also be a tool which will help them leverage their systems to be prepared for any attack of this manner.

The Blockchain revolution has just begun. No matter what you think about the potential of this technology, you need to keep yourself abreast with what the world is doing related to its application. An important part of this process is an exchange of ideas between the bright minds. Since the concept of Blockchain came into light, everybody is trying to find its use in different industries. Some countries are more inclined towards working to implement it in Banking, some in supply-chain and so on. They can learn from each other’s approach.

Blockchain Business Conference, organised by Fintech Valley Vizag is a platform, where experts around the globe meet to exchange ideas on Blockchain use cases and it is happening on 9th – 10th October 2017 in Vizag To book tickets or to explore sponsorship opportunities go here.

more insights

Amidst the cold-bloody wars of the 20th Century, which took place in the heart of the European mainland between 1945 and 1956, peace and harmony was far from reality.

Industrialists and coal mining magnates came together to forge a dynamic peace treaty between six founding nations, namely Belgium, France, Germany, Italy, Luxembourg and the Netherlands. The treaty would end a decade of instability and ensure peace and active trade between all the neighbouring countries in the continent. The Treaty of Rome in 1957 gave birth to the European Economic Community (ECC), now actively referred to as the European Union (EU). Ever since then, the enitre continent has seen surplus productivity and trade.

At the dawn of 2018, the world has moved beyond the internet and dial-up broadband. A new entity has begun seeping into conversations all across the globe, and it’s no longer a whisper in the corridor. Blockchain Technology! The ledger based technology and its practical applications in industries and multiple sectors has sparked off discussions in government bodies and central authorities. The possibility of reducing lag time in manufacturing, and the prevention of money laundering in the financial services market has peaked the people’s interest in this relatively new, yet rapidly expanding, technology!

But the underlying truth is that since the development of the ledger based technology is still in the nascent stage, its growth is mildly pocketed across different geographical zones. This arises due to differences in economic stability and structural autonomy.

Countries in Europe such as Germany, Switzerland, France, Norway and Denmark pump in millions of euros into technology and innovation, whilst smaller countries in the area scramble to handle the cost and magnitude for the implementation of blockchain technology. This diverse rate of development is what slows, and gradually wears, the industry down.

In April 2018, 22 countries of the European Union signed a strategic charter to facilitate the communication and transfer of knowledge and data regarding blockchain technology. This new council, dubbed as the European Blockchain Partnership, consists of national superpowers such as France, UK, Germany, Norway, Spain and the Netherlands as well.

The creation of a second generation union displays their desire to re-write their own history. Their history, in question, being a continent coming together to avoid conflict, is now a continent coming together for development and technological growth.

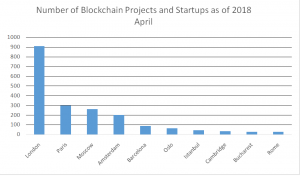

The announcement of a €340 Million (roughly 400 million USD) EU Blockchain Fund along with creation of a Blockchain Observatory Forum has hastened the pace of the development of blockchain technology and regulated cryptocurrencies in the continent! Spain launched the first multi-national consortium known as Alastria, which will connect multiple verticals from diverse industries under one blockchain ecosystem.

The financial services market is expected to invest close to €1.2 Billion (roughly 1.4 Billion USD) by 2021 to implement blockchain technology for cross-sector remittance and payments. The Forum is also exploring investments into Clean Energy, Healthcare and even Transportation, with an investment cap of €800 Million (approx. 900 Million USD) till 2020. The number of startups and companies focussing on blockchain technology and cryptocurrency has risen seismically over the last 18 months due to these progressive attributes.

The future of this technology lies in its active sustenance as a fully functional business model. Central funding on a regular basis can result in the technology going defunct, and possibly its death before it could even be born.

Hence, countries and businesses have started participating actively in summits and conferences in order to connect with the international market.

One such summit is the highly anticipated World Blockchain Summit Frankfurt Edition, which is being conducted by international events company Trescon. The summit, through governmental endorsements, will provide a platform to connect the European blockchain industry with different trans-continental requirements, that will inevitable breathe a new life into the blockchain universe within Europe.

more insights

Blockchain technology is catching up with the rest of the world. Slowly, but surely, it is becoming a part and parcel of institutions both financial and otherwise around the world. But how is it catching up closer to home in India? This article will examine the state of blockchain technology in India.

RBI takes the initiative: The Reserve Bank of India has successfully tested blockchain technology for trade application. The evaluation was carried out in partnership with domestic banks and other financial institutions.

The adoption of blockchain technology among stock exchanges and trade platforms is increasing. The potential of blockchain technology to automate trade settlements and transactions can prove to be a huge cost saver for financial institutions.

Successful exploration of blockchain technology by the country’s central bank will also help the growing Indian Bitcoin community. In recent times, the country has seen a dramatic increase in Bitcoin adoption and the government’s openness to the technology can translate to a lenient regulatory view towards the cryptocurrencies.

Baby steps for a giant venture

However, it is difficult in keeping up with technology and India’s financial sector knows it too well. 56% of companies interview by PwC said that though blockchain is a part of their innovation strategy, many are yet to implement it. The most common use, according to the survey, are in the fund’s transfer, digital identity and payments infrastructure.

Banks in India have begun using blockchain in their daily transactions. But such instances are far and few in between. The main attraction for adoption is that it eliminates multiple processes which save both time and cost. The main detraction only a handful of financial institutions understand what blockchain really is.

With The Reserve Bank of India’s own blockchain forays, a new precedent will be set for the banking sector in India with increased awareness of the many benefits of the technology. A fair understanding of the technology will lead to a wider adoption of blockchain technology.

The real beneficiaries of blockchain

As enterprises all over the world become aware of the many benefits of blockchain, it is the Indian public-sector that stands to gain the most from blockchain technology as it is a disruptive force changing the very dynamics how traditional processes are done across industries- from financial transactions to insurance and more.

Blockchain technology eliminates cyber fraud to a large extent, a reason why the financial sector has been the early adopter of the technology as of late. The key-high security attributes are cryptographics for the hardware, tamper-proof cards for the management and malware protection for the database.

According to the global research firm MarketsandMarkets, the Blockchain market is estimated to grow from $210.2 million in 2016 to $2.31 billion by 2021. ‘The Banking, Financial Services, and Insurance (BFSI) sector is expected to dominate the market with the largest share, as the need for banking and financial transactions have evolved from a traditional payments systems to be seamlessly integrated into new systems,’ it added.

The growth prospect of blockchain technology is what makes it a lucrative deal not just to financial institutions but also state governments of the world.

A governments tryst with technology

The flagship initiative of the State of Andhra Pradesh, Fintech Valley Vizag, aims to bring together industry, academia and investors alike to innovate, co-create and build the fintech ecosystem by making Vishakapatnam the fintech epicenter of the world. Similar initiatives by world governments around the world are aimed at creating employment opportunities by aiming to tap into emerging technologies. As such they are exploring various avenues with which they can fully tap into the phenomenon of blockchain technology.

The onus will ultimately fall on the execution of the initiative which will ultimately eclipse the methods adopted by other state agencies around the world. This will ultimately decide the success rate of initiatives like Fintech Valley

Fintech Valley Vizag is hosting the Blockchain Business Conference in Vizag, the heart of India’s Fintech capital of Andhra Pradesh, The event will bring you an exclusive group of leading FSI executives, regulators, entrepreneurs and academics from around the globe exploring how blockchain technology will impact the financial services industry.

It is taking place on 9th – 10th Oct 2017 at the Novotel Hotel in Vizag, India.

For sponsorship and speaking opportunities, register here.

more insights

‘It’s not the organisations that are competing. It’s the Supply-Chains that are competing!’

– Wael Safwat, Supply Chain Management Association (SCMAO)

Every day in the world, a crypto-trading millionaire is born. With blockchain startups pushing the fifth gear into launching their ICOs and raising money, the underlying truth of the viability of blockchain technology lies within its implementation. The hard truth!

Conversations surrounding the industry application of the ledger based technology sprung forth from the Financial Services and Banking sectors, but at the turn of mid-2018, it looks like the most cumbersome industry has turned favourable. Supply-Chain Management (SCM) and Manufacturing have opened their doors to blockchain.

Supply-Chain Management, in totality, deals with the procurement, production, storage and delivery of a product. Hence the backbone of supply-chain management, which is Logistics and Handling, has found the immediate requirement for blockchain technology.

The Logistics and Handling industry, within the realms of the international economy, has seen a downward spiral over a span of just 5 years. From one of the leading industries, in terms of Man Power, Investments and Sheer Size, the logistics division had reached an impasse. Industry giants like MAERSK and L&T (Larsen and Toubro) have laid off nearly 20,000 employees across the globe, and liquidated assets amounting to Millions of dollars, to cover up losses. This included the closing of their hazardous elements transportation division and the sale of their 1,000 strong vessel fleet. Why?

Well that is primarily due to a drastic rise in operational and situational costs across the globe, affecting multiple verticals. Rising fuel prices, decrease in subsidies from regulatory authorities, tracking and storage have been steadily cutting into the industry’s pockets for the last 8 financial quarters.

And the manufacturing industry, whose backbone is also the logistics and handling division has seen a seismic decline over the years. In the wake of all the statistics and numbers, the future of the Supply-Chain industry was looking bleak.

Hence, in a series of landmark announcements, big players from the SCM and Manufacturing industry have declared their immediate need for a scalable and manageable solution. And the prayers were answered.

To gain lost time, and to understand how blockchain can help their distress wings, organisations like the manufacturing juggernaut Saint-Gobain, who are present in over 50 countries in the world, have initiated conversation with consultants from BlockchainDriven. This is to understand how an immediate and responsive system can be created on a blockchain, highlighting the importance of logistics and handling.

Executives from automobile-parts manufacturing giant Sterling Consolidated have also met with the aforementioned company, to explore options in inventory management and stock handling!

And that’s not the least of it. Walmart has been using blockchain to track all the chicks and fowls at their poultry farms, which are spread over 300 farms in about 25 countries. Barclays has been keeping track of their 100 million USD butter exports segment using blockchain technology.

Blockchain in cryptocurrency might provide a decentralized unit to conduct monetary transfers across borders, by surpassing local and international regulations. In the case of SCM and Manufacturing, blockchain can provide solutions to blaring problems with inventory management, stock handling, product tracking and transportation.

To simplify it further, consider the application of blockchain technology into the stock inventory management vertical. By constructing a distributed ledger with all the details pertaining to the location, position, weight, dimensions and other ambiguous constraints, the on-ground logistics team will be able to manage the outbound time for the product’s movement, which advertently increases the response time. It’s always been, and will always be, an efficiency game.

So the three reasons can be cumulatively summed as: 1) Efficiency 2) Logistics & Handling speed and 3) Detailed accounting and data handling.

In retrospect, the cost of implementation of blockchain technology has been a stringent concern for organisation that fall out of the Fortune500 and Fortune1000 lists. So, blockchain driving organisation Apla Blockchain has stepped up to the batting plate with the answer. The company provides ledger based solutions to startups and SMEs (Small-Medium Enterprises), at cost effective rates.

Apla Blockchain is one of the platinum sponsors for the upcoming World Blockchain Summit Frankfurt Edition. You can meet with them and explore blockchain solutions for your organisation, by confirming your participation for the event over here.

more insights

Manufacturing is a key driver of the global economy. This sector alone accounts for nearly 17% of global GDP, according to the World Bank. With the benefits like reducing costs by multiples, decreasing lead time to focus on other core competencies and other great benefits, the application of blockchain will enable manufacturers to generate greater visibility within their manufacturing process and simplify mundane and costly steps. Unfortunately, the industry has always been rife with inefficiency and quality-control problems. Fake products can make their way to market because the current system lacks a way to track what’s real and what’s not.

The many problems we see today in manufacturing – from counterfeiting and poor quality to inefficient processes and a lack of trust in production is due to the negligence of manufacturers. Increasingly, with complex manufacturing processes, the demand for parts and material integrity, within the supply chain, needs to be improved to combat increases in lead time and ultimately lower the cost of production.

Leaders see blockchain as transformative

TSMC (Taiwan Semiconductor Manufacturing Company) is the world’s largest chip foundry, responsible for over 55% of the world’s chip production and is profiting heftily from the crypto mining boom.

C. C. Wei, co-chief executive of TSMC, said at the company’s Q1 2018 earnings call that the first quarter revenue of $8.46 billion was “mainly driven by a strong demand from high-performance computing such as cryptocurrency mining and increases from both automotive and IoT.”

The company also noted that crypto mining gave a timely boost that offset weaker demand for smartphone sales. In April, the company cut its sales target due to the lack luster performance of Apple’s iPhones. Taiwanese authorities know that blockchain poses as a great economy booster and their positivity towards the innovation is a sign that the Taiwan economy is ripe for blockchain adoption.

The world’s first blockchain smartphone

Foxconn, one of the the largest employers and a multinational electronics contract manufacturing company situated in Taiwan has developed a smartphone where users are able to store and use digital currencies securely. A plethora of tokens will be integrated by the device. It will also enable owners to shop on crypto-accommodating sites like Overstock.com and Expedia, converting liquid money into particular tokens if necessary.

Finney, created by Sirin Labs, will be a phone that allows people to store and use digital currencies without having to pay transaction fees, Bloomberg reported. This means you won’t need to carry USB sticks along with your digital wallet. Instead, everything will all be stored on the phone.

Blockchain’s industrial impact:

From sourcing raw materials to delivery of the finished product, blockchain can increase transparency and trust at every stage of the industrial value chain. Among the pain points it could help address are:

* Supply-chain monitoring for greater transparency

* Materials provenance and counterfeit detection

* Engineering design for long-duration, high-complexity products

* Identity management

* Asset tracking

* Quality assurance

* Regulatory compliance

Blockchain-powered solutions can seamlessly aggregate all of this information, delivering significant value for industrial companies, and can also help unlock the full potential of other advanced technologies like augmented reality, IoT and 3D printing.

There is plenty of room for industrial companies to be blockchain pioneers. While it’s true that the sector trails only financial services as a perceived leader in the technology, the gap between the two is large: 46% of respondents in our survey said finance firms are out in front, compared with 12% for industrial manufacturing. Meanwhile, the World Blockchain Summit will highlight the common pitfalls that sabotage promising blockchain projects with intelligent planning, strong collaboration and a clear strategic vision.